Silver futures hit all-time high Rs 2,32,741/kg on MCX as global prices top $75/oz. Geopolitics, industrial demand from solar/EVs, and Fed rate cuts drive the rally full analysis.

New Delhi, December 26, 2025, Time 8:36 PM IST – Silver futures shattered records on the Multi Commodity Exchange (MCX), soaring to an unprecedented Rs 2,32,741 per kilogram on Friday, fuelled by a perfect storm of geopolitical tensions, structural supply shortages, and booming industrial demand.

The March 2026 contract jumped Rs 8,951 or 4 percent in a fifth straight session of gains, marking a staggering Rs 29,176 or 14.33 percent rise since December 18.

Globally, Comex silver futures pierced the $75-per-ounce barrier for the first time, hitting $75.49 amid heightened safe-haven buying.

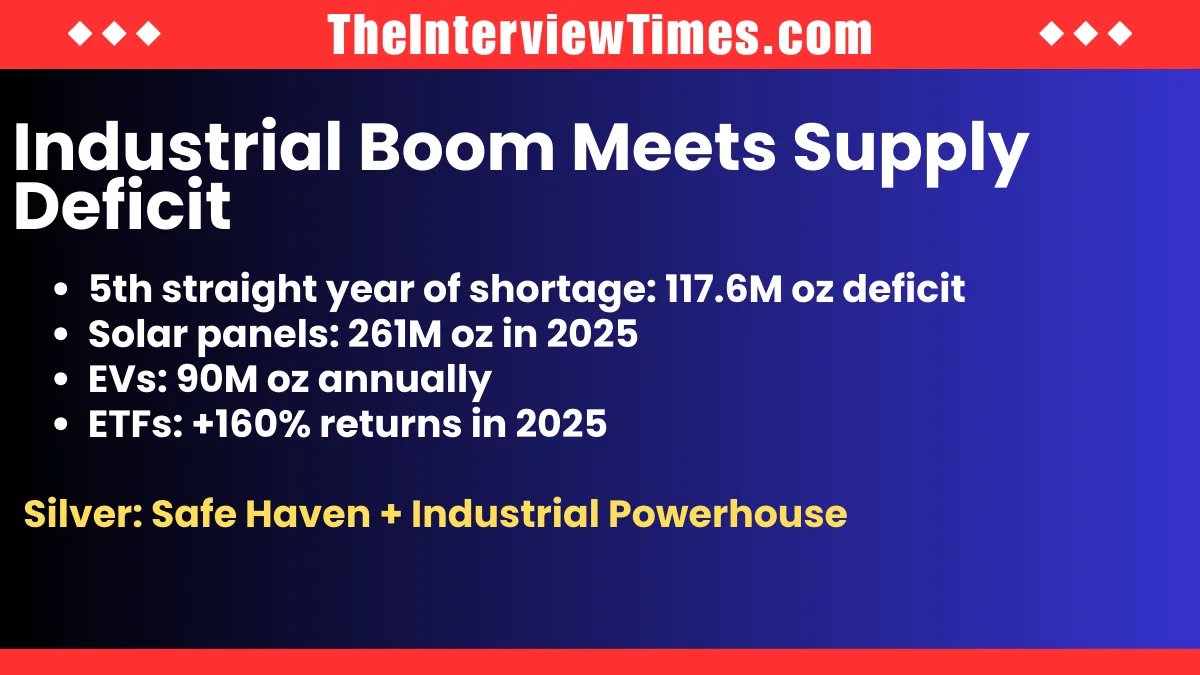

This silver futures surge underscores the white metal’s dual role as both an investment haven and industrial powerhouse, with market experts warning of prolonged tightness into 2026.

Geopolitical Tensions Stoke Safe-Haven Fire

Escalating global flashpoints have propelled silver futures higher, as investors flock to precious metals amid uncertainty.

Jigar Trivedi, Senior Research Analyst at Reliance Securities, pinpointed the US Coast Guard’s seizure of a sanctioned Venezuelan super tanker carrying crude oil earlier this month, plus attempts to intercept two more Venezuela-linked vessels over the weekend, as key triggers.

Ongoing Russia-Ukraine hostilities and a recent US military strike against ISIS in Nigeria further amplified risk aversion, channelling funds into bullion.

Gold mirrored the frenzy, with MCX February futures climbing 0.72 percent to a record Rs 1,39,091 per 10 grams, while Comex February gold rose $58.8 or 1.3 percent to $4,561.6 per ounce.

These developments have reinforced silver’s appeal in a volatile world, with traders betting on defensive positioning through year-end.

Industrial Demand Outpaces Supply

Silver futures’ record run extends beyond geopolitics, rooted in chronic market imbalances. The global silver market braces for a fifth straight year of supply deficits, projected at 117.6 million ounces in 2025 despite a slight narrowing from prior peaks, as mine output lags demand.

Industrial consumption now over half of total demand explodes from solar panels, electric vehicles (EVs), and electronics, with solar alone poised to devour 261 million ounces this year, up 5.5 percent.

EV production could claim 90 million ounces annually by 2025’s end, driven by charging infrastructure and battery tech, while solar subsidies in China and India add fuel.

Silver ETFs have posted over 160 percent returns in 2025, drawing massive inflows amid inventories at multi-year lows.

Analysts forecast solar alone consuming 20 percent of annual supply by 2027.

Read Also: NATO Chief Mark Rutte Rejects “European NATO” Idea, Backs 5% Spending Pledge

Fed Rate Bets and Macro Tailwinds

Expectations of US Federal Reserve easing amplify the silver futures momentum. Markets price in two quarter-point cuts in 2026 as inflation cools and labor data softens, weakening the dollar and boosting non-yield assets.

The Fed’s December meeting signalled a potential pause post-third cut this year, but mixed GDP and consumer signals keep dovish hopes alive.

A softer dollar, central bank gold buying exceeding 600 tonnes in 2025, and ETF inflows create a bullish cocktail for silver. Commodity desks predict the rally persists into early 2026, barring major de-escalations.