Winklevoss twins predict Bitcoin will hit $1M as Gemini’s Nasdaq IPO soars 14%. Discover their bold forecast, IPO details, and crypto’s future. | TheInterviewTimes.com

The Winklevoss twins’ Bitcoin prediction of $1 million per coin has ignited excitement in the crypto world, coinciding with their exchange Gemini’s blockbuster Nasdaq IPO, which soared 14% on debut. Tyler and Cameron Winklevoss, known for their early Bitcoin investments, see the cryptocurrency as “gold 2.0,” poised to disrupt traditional finance. As Gemini’s public listing marks a milestone for crypto infrastructure, their bold forecast underscores Bitcoin’s transformative potential. Explore the details, drivers, and implications of this seismic moment for digital assets.

Gemini’s IPO: A Crypto Milestone

Gemini’s initial public offering (IPO) on Nasdaq, under the ticker GEMI, raised $425 million at a $3.3 billion valuation, with shares priced at $28. On debut, the stock surged as high as 32% before closing 14% up, reflecting investor confidence in regulated crypto platforms. Founded in 2014 by the Winklevoss twins, Gemini emphasizes compliance, bridging traditional finance and blockchain technology. The IPO’s success, detailed in Nasdaq’s market reports, provides capital for global expansion and signals crypto’s growing mainstream acceptance.

This milestone follows a wave of crypto-related IPOs, with Bitcoin trading around $60,000, fueled by ETF approvals and macroeconomic shifts. Tyler Winklevoss called the IPO the “first inning” of crypto’s adoption curve, a sentiment echoed in their CNBC interview. Gemini’s public debut could inspire other crypto firms to follow suit, potentially injecting billions into the ecosystem.

MUST READ: Top 10 CEOs of 2025: Brand Finance Rankings and Their Game-Changing Achievements

Why the Winklevoss Twins’ Bitcoin Prediction Matters

The Winklevoss twins’ $1 million Bitcoin forecast, reiterated during Gemini’s IPO, builds on their decade-long crypto advocacy. As early investors who amassed billions in BTC since 2013, their prediction carries weight. They argue Bitcoin’s fixed 21 million coin supply mirrors gold’s scarcity but surpasses it in portability and divisibility. “Bitcoin is gold 2.0,” Tyler stated, noting that capturing just 10% of gold’s $13 trillion market cap could push BTC to $619,000 per coin, with further growth plausible.

Cameron Winklevoss emphasized Bitcoin’s role as a hedge against fiat devaluation and geopolitical risks, aligning with bullish forecasts from MicroStrategy’s Michael Saylor and ARK Invest’s Cathie Wood. While skeptics cite volatility and regulatory hurdles, the twins’ track record and Gemini’s IPO success bolster their credibility.

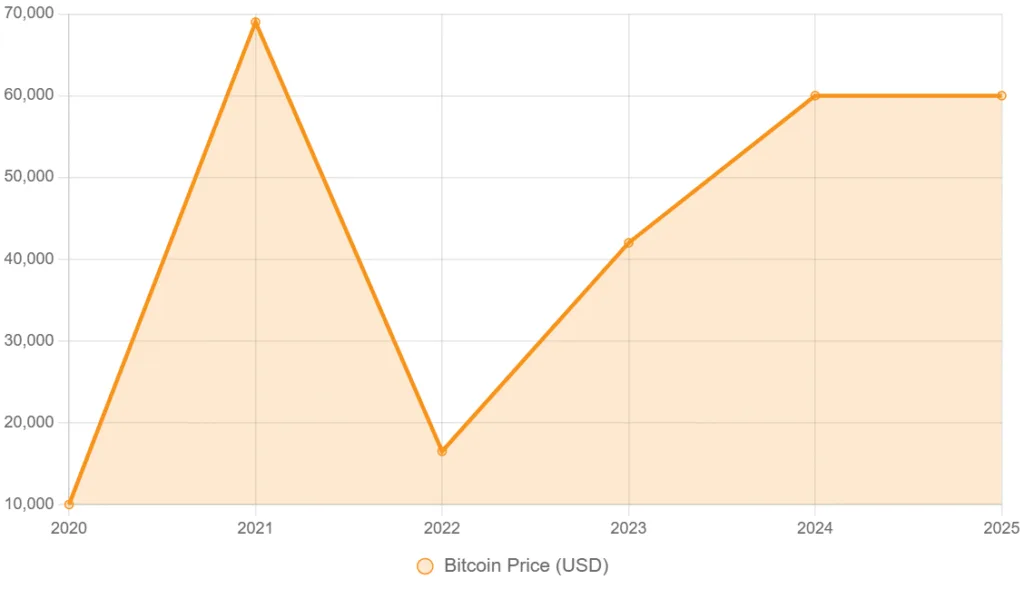

Winklevoss Twins Predict Bitcoin: Bitcoin Price Trends: A Visual Perspective

The chart below illustrates Bitcoin’s price trajectory from 2020 to 2025, highlighting its growth potential toward the $1 million mark.

The Winklevoss Twins’ Crypto Journey

Tyler and Cameron Winklevoss rose to prominence after their legal battle with Mark Zuckerberg over Facebook’s origins, later channeling their entrepreneurial drive into crypto. By 2013, they were among Bitcoin’s earliest adopters, purchasing 1% of BTC’s circulating supply. Founding Gemini in 2014, they prioritized regulatory compliance, earning a New York BitLicense and building trust with institutional investors. Their $1 million prediction reflects a decade of conviction, now amplified by Gemini’s public status.

MUST READ: Disney Copyright Case: $600K Beauty and the Beast Verdict Reinstated

Winklevoss Twins Predict Bitcoin: Drivers and Challenges for Bitcoin’s $1M Goal

Several factors could propel Bitcoin toward the Winklevoss twins’ Bitcoin prediction:

- Institutional Adoption: Spot Bitcoin ETFs have attracted $15 billion in inflows since 2024, per Bloomberg data. Gemini’s regulated platform is well-positioned to capitalize.

- Regulatory Clarity: The U.S. SEC’s evolving guidelines, as noted in CoinDesk reports, reduce barriers for mainstream entry.

- Economic Trends: Rising inflation and central bank digital currencies (CBDCs) bolster BTC’s appeal as a decentralized asset.

- Technological Advances: Layer-2 solutions like Lightning Network enhance scalability, making Bitcoin practical for transactions.

Challenges include energy consumption concerns, potential regulatory crackdowns, and competition from altcoins. However, the twins view these as surmountable, with Gemini’s IPO validating crypto’s staying power.

How Investors Can Prepare for Bitcoin’s Growth

For investors eyeing Bitcoin’s potential, consider these steps:

- Secure Storage: Use hardware wallets like Ledger or Trezor for long-term BTC holdings.

- Trusted Platforms: Trade on regulated exchanges like Gemini, as highlighted in our crypto exchange guide.

- Risk Management: Diversify portfolios and avoid investing more than you can afford to lose, given crypto’s volatility.

- Stay Informed: Follow TheInterviewTimes.com for updates on Bitcoin trends and regulations.

Explore more on Bitcoin investment strategies to navigate this dynamic market.

FAQ: the Winklevoss Twins Predict Bitcoin

- What is the Winklevoss twins’ Bitcoin prediction? They forecast Bitcoin reaching $1 million per coin within a decade, driven by its scarcity and adoption.

- Why did Gemini go public? To raise $425 million for expansion and cement its role as a regulated crypto leader, valued at $3.3 billion.

- How does Bitcoin compare to gold? Bitcoin is dubbed “gold 2.0” for its fixed supply and digital advantages, potentially capturing gold’s $13 trillion market.

The Future of Crypto and Gemini’s Role

Gemini’s IPO and the Winklevoss twins’ $1 million Bitcoin prediction mark a turning point for crypto’s mainstream integration. As institutional and retail interest grows, Bitcoin’s path to $1 million seems ambitious yet achievable. TheInterviewTimes.com will continue tracking BTC’s trajectory and Gemini’s performance. Do you agree with the Winklevoss twins’ Bitcoin prediction? Share your thoughts on X or in the comments below!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry high risks.