TheInterviewTimes.com | February 22, 2026 | 07:03 AM IST | New Delhi

NSE announces nanosecond trading speeds starting April 11, 2026, boosting capacity to 100 million orders per second. Sebi ED Sunil Kadam urges Indian markets to innovate locally amid AI push at StockTech 2026. Latest updates on NSE upgrades and market tech shift.

Mumbai hosted the 8th StockTech 2026 event on February 21, where key leaders outlined bold steps for Indian capital markets. National Stock Exchange Managing Director Ashish Kumar Chauhan revealed plans for nanosecond-level trading speeds in equities and derivatives from April 11, 2026. This upgrade positions NSE among the world’s fastest platforms, handling up to 100 million orders per second.

Sebi Executive Director Sunil Kadam used the platform to stress original innovation over foreign imitation. He referenced a recent scandal at the India AI Impact Summit 2026, where Galgotias University presented a Chinese Unitree Go2 robotic dog as its own “Orion” creation, leading to the institution’s expulsion. Kadam called for higher research spending to build India’s tech leadership.

NSE Speed Upgrade Details

NSE’s shift to nanosecond response times cuts latency by nearly 1,000 times compared to current systems. One second equals 100 crore nanoseconds, enabling faster order receipt, validation, and matching. This supports rising algorithmic and high-frequency trading volumes while improving price discovery and risk management.

The exchange boosts order capacity from 50-60 lakh to 10 crore per second and expands co-location facilities by two to three times. Trading firms can place servers near NSE systems to minimize delays. Real-time margin transfers across segments further enhance capital efficiency. NSE coordinates these changes with Digital Personal Data Protection Act rules and prioritizes cybersecurity.

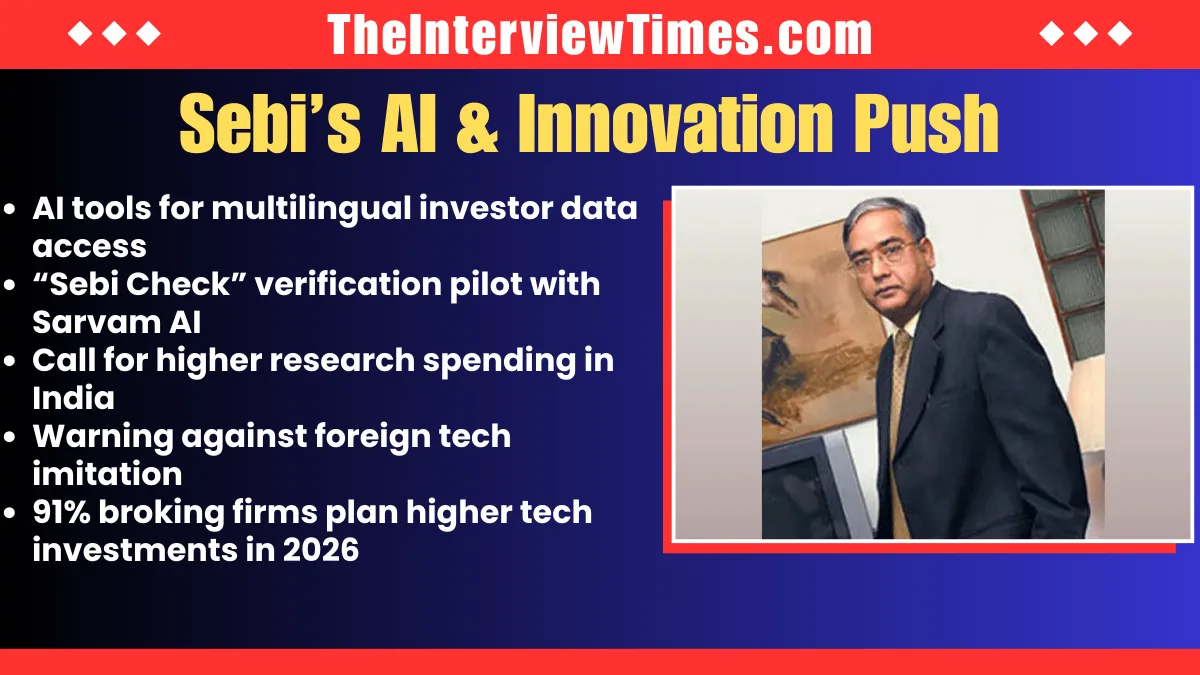

Sebi’s AI Push for Investors

Kadam highlighted AI’s role in transforming market business models, stressing adaptation across the ecosystem. Sebi develops an AI tool offering interactive, multilingual company and market data for investors. A recent pilot with Sarvam AI promotes the “Sebi Check” verification tool in multiple languages.

“We all need to adapt to AI technology no matter how good or bad we are in understanding it,” Kadam stated. He warned against copying foreign tech, saying India must channel funds into homegrown research to lead globally.

Industry Tech Spending Surge

ANMI’s StockTech 2026 survey, released by Kadam, shows 91 percent of broking firms planning higher tech investments this year. This reflects a shift to technology-driven trading, with NSE pioneering real-time systems since 32 years ago.

Chauhan noted NSE’s AI collaboration with a global university and new products like electricity futures and 10-gram gold futures to deepen retail participation. Paul Ghosh, NSE’s Market Operations Director, called the upgrade a shift toward greater reliability and scalability.

These developments signal India’s markets gearing up for explosive growth, blending speed, AI, and original innovation.

Top News: Chiraiya Teaser Ignites Marital Rape Debate on JioHotstar